Navigating the Volatility of Commodity Prices

- alan scherer

- Nov 7, 2023

- 2 min read

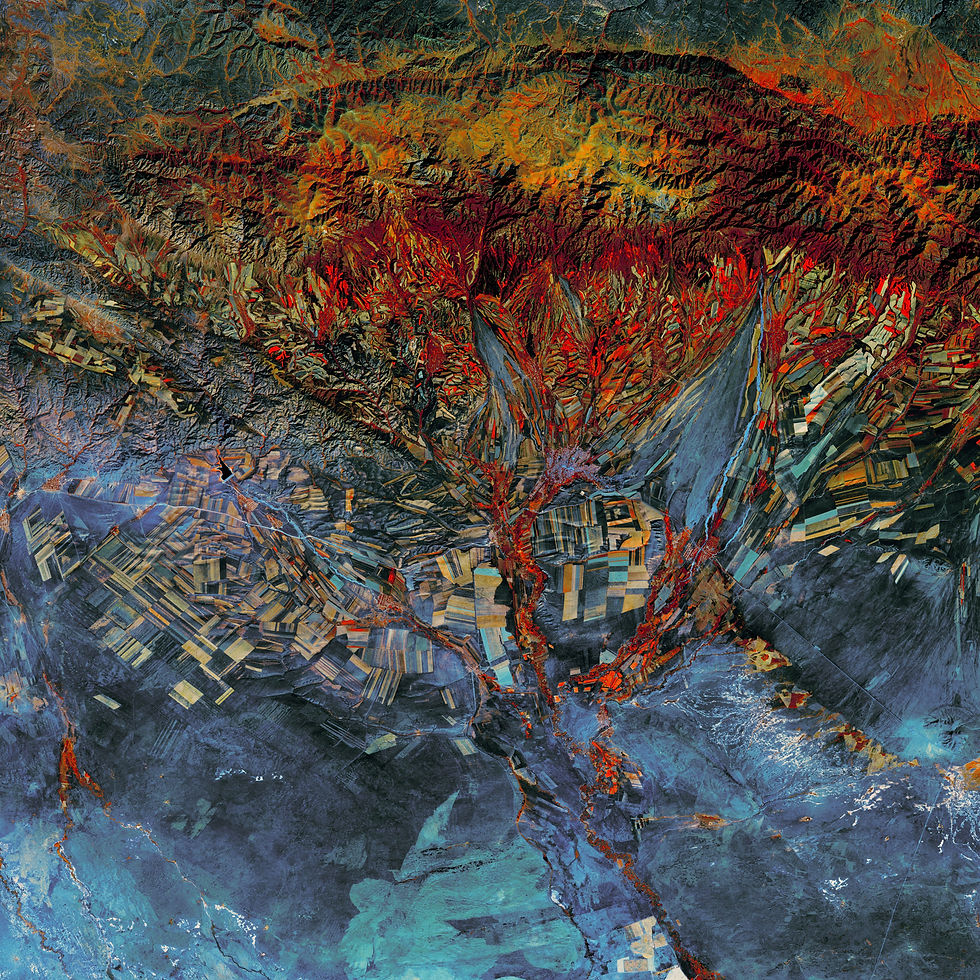

Navigating the Volatility of Commodity Prices Image Description: A graph depicting the fluctuation of commodity prices over time. The graph shows a series of peaks and valleys, representing the volatility of the market. The x-axis represents time, while the y-axis represents the price of commodities. The graph is color-coded, with green indicating periods of price increase and red indicating periods of price decrease. The image is accompanied by a caption that reads "Navigating the Volatility of Commodity Prices." Commodity prices are known for their volatility, constantly fluctuating due to various factors such as supply and demand, weather conditions, geopolitical events, and economic indicators. For businesses like SK&G Trading Co., which specialize in buying and selling agricultural commodities, understanding and navigating this volatility is crucial for success. In this blog post, we will discuss some examples, thoughts, and tips to help you navigate the volatility of commodity prices. 1. Stay Informed: Keeping yourself updated with the latest news and market trends is essential. Subscribe to industry newsletters, follow reliable sources on social media, and regularly check commodity price indexes. By staying informed, you can anticipate potential price movements and make informed decisions. 2. Diversify Your Portfolio: One way to mitigate the risk of price volatility is to diversify your commodity portfolio. Invest in a variety of commodities rather than relying on a single one. This way, if the price of one commodity falls, you have others that may offset the losses. 3. Understand Seasonality: Many commodities have seasonal price patterns. For example, the price of grains tends to rise during the planting and harvesting seasons. By understanding these seasonal patterns, you can plan your buying and selling strategies accordingly. 4. Monitor Supply and Demand: Supply and demand dynamics play a significant role in commodity price fluctuations. Keep an eye on factors that may impact supply, such as weather conditions, natural disasters, and geopolitical events. Similarly, monitor demand factors like changes in consumer preferences and global economic conditions. By understanding supply and demand trends, you can anticipate price movements. 5. Utilize Risk Management Tools: Consider using risk management tools such as futures contracts, options, and hedging strategies to protect yourself against price volatility. These tools allow you to lock in prices in advance or protect against potential losses. 6. Build Relationships: Developing strong relationships with suppliers, buyers, and industry experts can provide valuable insights and information. Networking with others in the industry can help you stay ahead of market trends and gain a competitive edge. 7. Plan for the Long Term: Commodity prices can be unpredictable in the short term, but over the long term, they tend to follow certain trends. Develop a long-term strategy based on historical price patterns and fundamental analysis. This will help you make more informed decisions and reduce the impact of short-term volatility. In conclusion, navigating the volatility of commodity prices requires a combination of knowledge, analysis, and strategic planning. By staying informed, diversifying your portfolio, understanding seasonality, monitoring supply and demand, utilizing risk management tools, building relationships, and planning for the long term, you can navigate the ups and downs of the commodity market more effectively. Remember, volatility presents both challenges and opportunities, and with the right approach, you can thrive in this dynamic industry.

Comments